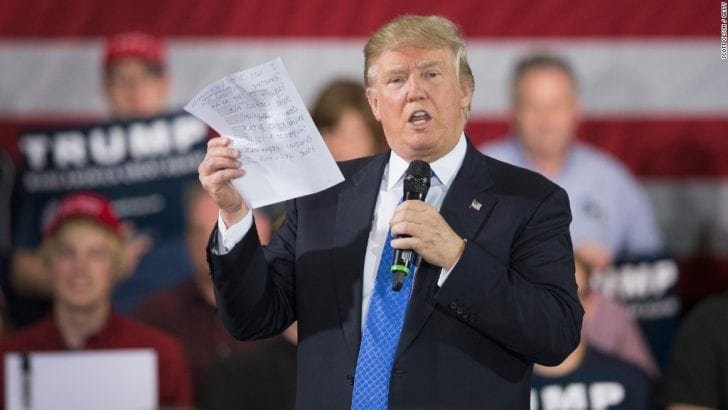

Despite Rhetoric, National Debt surpasses $21 trillion Mark under Trump’s Watch

It’s been a year now since President Trump vowed to eliminate the national debt over a period of 8 years. Just a year on from the pledge, one can certainly label his deliberations to have been whimsical at best.

The Committee for a Responsible Federal Budget estimates that over the next decade, the national debt is set to soar much higher. They opine that annual deficits could rise beyond $2.1 trillion on an annual basis.

The U.S. Treasury recently revealed that national debt has well and truly surpassed the $21 trillion mark. This revelation comes right after Congress passed with Trump’s approval, a suspension of federal debt limits last month. With the new legislation in place, the government is at will to borrow an unlimited amount of funds until March 1, 2019.

At the time of assumption of office on January 20th, 2017, the U.S. national debt stood at $19.9 trillion as per the U.S. Treasury data. In the year that has followed, the GOP (Grand Old Party) led Congress has passed tax cut bills amounting to $1.5 trillion. While at it, Congress also agreed to a two-year spending deal that promises to drive the deficit and debt much higher.

Economics at Play

In past regimes, more specifically during Obama’s reign at the helm, Republicans widely voiced their concerns on the fiscal state of the nation. The noise was loudest when the national debt rose from $10.6 trillion to $19.9 trillion, almost double the initial.

At present, not much has been heard from Republicans at Capitol Hill and in the White House. Republican Senator Rand Paul, recently voiced his disbelief while speaking on the Senate floor about the sudden change in tune. He expected the same criticism they accorded the Obama administration to be directed towards the present Trump administration.

A fellow Republican senator, Bob Corker, supported his notions through social media on Twitter. He cited the growing levels of national debt as the greatest impediment for the American nation.

Just how dangerous is the looming threat of growing national debt? It’s not quite clear at the moment. In September of last year, the President went on record saying that he was open to eliminating the debt ceiling entirely. The recent bills passed by Congress show a concerted effort by politicians to do this.

President Trump stated that there are a number of ‘good reasons’ for lifting the debt cap ceiling. The debt ceiling is a measure put in place by Congress that regulates just how much the federal government can borrow. Indeed, the president’s recent comments are in stark contrast to his previous stand on the matter of debt control.

At present, the federal government has been spending more money than it collects in taxes. Most of the surplus money gets borrowed from investors. In effect, this has led to the mountainous state of the national debt.

Worry

The last time the U.S. was debt free was in 1835. Given the vast amount of debt the country is in, it is quite unlikely that the country will be able to pay off its debt in entirety anytime soon.

Americans should be worried about recent happenings due to a number of factors. By borrowing in order to raise money, the federal government seems to be falling short. Instead, by refocusing their energies on comprehensive tax collection, the current national debt state would be much lower.

There’s also the other issue with borrowing, interest rates. Since the government is unlikely to finish paying off debts in time, the interest rates are likely to keep rising. Ever since the financial crisis, interest rates have been quite low. This has fostered a habitable environment for investors to lend money to the federal government.

Probable Solutions

Improved economic growth could provide investors with alternative options for investment. With a good economy in place, the United States could compete by offering improved higher interest rates.

Since debts accrued overtime need to be constantly repaid, the U.S has been losing. This is because the federal government has been offsetting debts by taking more debts. With time, this has led to compounding implications in terms of the state of national debt.

The only way out of this conundrum would probably be inflation and continued economic growth. The government can create a state of inflation by increasing the amount of money in circulation. In doing so, tax revenues are bound to increase, that way, the federal government will be better poised to pay off fixed debts.

With time, economic growth can help reduce interest burdens and cushion citizens from the current state of the national debt.

More inAdvice

-

`

Tips for Dealing with Car Problems in Extreme Winters

Once again, it’s that time of year. Temperatures plummet into singles and negative digits. Even the wind feels dangerous and painful....

January 10, 2024 -

`

The Differences Between Car Insurance & Car Warranty

Car Insurance: Your Safety Net on the Road First up, let’s talk about car insurance. Think of it as your financial...

January 9, 2024 -

`

Auto Insurance Is Becoming More Expensive as Car Repair Costs Go Up

We have all been there, right? That gut-punch moment when the mechanic hands over the repair estimate, and you are left...

January 8, 2024 -

`

4 Top-Class Cars From the 90s to Buy in 2024

In the 90s, cars were simple, flexible, and comfy. Those cars were fun to drive, cheerful, convenient, and safe. This is...

January 5, 2024 -

`

The Top 6 Innovative Electric Cars on the Road Today

The electric vehicle (EV) revolution is well and truly upon us. Today’s EVs represent the pinnacle of cutting-edge technology and sustainable...

January 3, 2024 -

`

Henry Frader: A Citroen Lover

Car collection is a hobby not everyone can afford. Costly hobbies require a long time to surpass a certain level of...

January 1, 2024 -

`

The Self-Driving Cars: The First Steps to New Regulations

The future in which we will not have to steer our vehicles seems to be just around the corner. However, a...

December 28, 2023 -

`

Impact of High-Tech Cars on Repair Businesses

In Minnetonka, Minnesota, Brandon Mehizadeh oversees a collision shop facing the challenges posed by high-tech cars. A recent incident involving a...

December 27, 2023 -

`

Tesla Cybertruck Finally Arrives – But Will It Be a Sales Success?

After four years of anticipation, the Tesla Cybertruck finally hit the roads, marking a revolutionary stride in electric trucks. In a...

December 24, 2023

You must be logged in to post a comment Login