The Cheapest Cars to Insure

While definitely not the only contributing factor, the car you chose to drive plays an important part in getting a cheaper car insurance. Who knows, maybe reading this article will save you some cash.

Even though a good history will definitely help you keep those premiums low, purchasing a car that is inherently cheaper to insure is still pretty high up on the list of ways you can drive down the cost of your insurance.

What are the insurance rates based on?

What are the insurance rates based on?

Crash tests are critical. A model that gets higher marks in crash tests conducted by the National Highway Traffic Safety Administration and the Insurance Institute for Highway Safety will automatically have lower rates.

In the end, claims history, including the cost of damage both cars suffer from a car crash and the level of personal injuries involved of the model in question affect the rates for the insurance. To put it simply, vehicles that are the cheapest to insure are usually those that are traditionally driven by safe drivers. Most commonly, this refers to parents that drive their children.

The top 10 cheapest cars to insure:

The top 10 cheapest cars to insure:

For this year, nine out of ten cars that are on this list are family-friendly SUVs. Believe it or not, five are manufactured by Jeep. The prices for insurance of these vehicles are usually taken from an annual study done by Insure.com.

Subaru Forester 2.5i AWD

Subaru Forester 2.5i AWD

This family-friendly SUV from Subaru has a starting price of just over 22,000 dollars. It is a four wheel drive and is one of the cheapest cars when it comes to insurance premiums. To insure this car, you will need less than 1,200 dollars. To be more precise, you will need 1,196 dollars.

Jeep Patriot Sport 2WD

Jeep Patriot Sport 2WD

With an average annual premium of 1,190 dollars, this Jeep’s model is quite cheap to insure. And the fact that the manufacturer’s suggested retail price starts as low as 18,000 dollars really makes this car a value pick for anyone who is trying to save up while still buying a new car.

With an average annual premium of 1,190 dollars, this Jeep’s model is quite cheap to insure. And the fact that the manufacturer’s suggested retail price starts as low as 18,000 dollars really makes this car a value pick for anyone who is trying to save up while still buying a new car.

Buick Encore 2WD

Buick Encore 2WD

To be fair, this Buick’s model is tied with Jeep when it comes to the average annual premium. It will also cost you 1,190 dollars; we simply put it lower on the list since it looks better. The manufacturer’s suggested retail price starts at 22,290 dollars.

Jeep Cherokee Sport 2WD

Jeep Cherokee Sport 2WD

If you want to save two dollars every year on insurance premiums and drive a Jeep, you can purchase Jeep Cherokee sport. However, the two dollars you save by only paying 1,188 dollars for insurance each year do not compare with the difference in the manufacturer’s suggested retail price which, for this car, starts at 25,000 dollars. Nevertheless, the car looks a lot more stylish than Patriot.

Subaru Outback 2.5L AWD

Subaru Outback 2.5L AWD

Yet another SUV on this list. The manufacturer’s suggested retail price for the 2018 model is 25,895, and you can insure it for only 1,187 a year.

Jeep Compass 2WD

Jeep Compass 2WD

The Jeep Compass is an SUV introduced for the model year 2007. A decade later, the new model is being favored by insurance companies around the states. This led to the average annual premium of 1,183 dollars. The retail price suggested by the retailer is standing at just below 21,000 dollars.

Honda CR-V

Honda CR-V

CR-V, the name of this car, stands for Compact Recreational Vehicle, and it has been around for well over two decades. However, the fifth generation has started with this year’s model, and it owns it when it comes to the safety rating with perfect scores for everything and 4 out of 5 stars for rollover. That leads to the cost of the annual premium being 1,170 dollars.

Jeep Wrangler Black Bear AWD

Jeep Wrangler Black Bear AWD

The Wrangler is one of the most widely recognized Jeep models. It has been winning awards for popularity and function for decades now. The fact that its premium is just 1,148 dollars just serves to further solidify its position as one of the best choices around.

Jeep Renegade Sport 2WD

Jeep Renegade Sport 2WD

We did warn you that Jeep is definitely the manufacturer to look for when it comes to low insurance rates. You can insure this one for 1,138 dollars a year.

Honda Odyssey

Honda Odyssey

On a list dominated by SUVs, Honda Odyssey takes the first place as the only minivan around. While you do lose some of the prestige of driving an SUV, you get a very safe family car that you can insure for only 1,112 dollars a year. However, the manufacturer’s suggested retail price is just under 30,000 dollars.

More inCar Insurance

-

`

10 Valuable Career Lessons for the 20s That Pay Off in Your 30s

Entering your 30s often feels like a moment of reflection. For many, it’s a time when you realize how much the...

February 8, 2025 -

`

Auto Industry’s Ongoing Disruption – What’s Changing?

The auto industry is undergoing rapid change, with several key factors reshaping its future. A recent report by PwC highlights significant...

February 1, 2025 -

`

How to Safely Drive Away from Wildfires – Essential Tips

Wildfires are unpredictable and dangerous, often spreading rapidly with little warning. A video from the Los Angeles wildfires showed abandoned cars...

February 1, 2025 -

`

Can Your Car Keep You Safe During an Emergency?

Natural disasters such as wildfires, hurricanes, and floods can occur unexpectedly, leaving little time to prepare. In such situations, your car...

January 25, 2025 -

`

Tesla Reveals 2025 Model Y Juniper – Here’s What’s New!

Tesla has revealed the 2025 Model Y Juniper, a refreshed version of its best-selling electric SUV. This update enhances design, comfort,...

January 25, 2025 -

`

How to Check Transmission Fluid for Optimal Car Performance

Maintaining your vehicle’s transmission is just as essential as other routine car maintenance tasks like oil changes or tire rotations. Knowing...

January 18, 2025 -

`

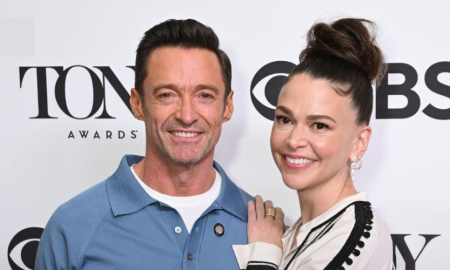

Sutton Foster and Hugh Jackman Spark Romance on L.A. Date Night

Hollywood is abuzz with the latest photographs of Hugh Jackman and Sutton Foster, who appear to be confirming their romance during...

January 16, 2025 -

`

How to Fix Car Window Off-Track and Align It Properly

When your car window gets stuck or misaligned, it’s often due to an off-track issue. Learning how to fix car window...

January 10, 2025 -

`

How to Drive a Stick Shift: A Quick Guide for Manual Beginners

Driving a stick shift requires coordinating the clutch, brake, and accelerator to control a car with a manual transmission. Manual cars...

January 3, 2025

You must be logged in to post a comment Login