Here’s How a Holidaymaker Parted With £30,500 Instead of Getting Insurance Coverage

On her travels to Cape Verde in January, Juliet Taylor was diagnosed with a kidney tumor and had to be airlifted to Tenerife for surgery and two blood transfusions. Tragedy struck again when she learned that her travel insurance provider, Axa, declared that they were only willing to cover a third of her care costs.

The travel insurance agency explained that she would have to personally cover the remaining £30,500 because she had failed to make a declaration of sleeping tablets she had when she bought the policy from the broker, Coverwise

Taylor shared that it never occurred to her that she had to mention the occasional bouts of insomnia she experienced every now and then. She mentioned that in her understanding, she had bought a policy that promised to provide cover in “unforeseen accidents and illnesses”. Before making the trip abroad, she said that a tumor situation was completely out of the picture. After she was admitted, she proceeded to spend a month in hospital.

Taylor seemed appalled upon discovering that insurance companies can actually refuse to pay claims on pre-existing medical conditions, even when the medical condition bears absolutely no relation to the reason for the claim. She expressed her disappointment on the insurance company’s resolve since £30,500 was everything she had in terms of pension earnings and accrued life savings.

Minefield

Incredibly, Axa shared that they had agreed to pay a third of Taylor’s medical costs as a “goodwill gesture”. This was largely because she purchased a basic policy meant for those with no prior health conditions

Travelers choosing travel insurance are usually in a dilemma when it comes to deciphering all the small print contained in the issued policies. As such, most of them find themselves as easy prey for the insurance companies to gobble.

In the Coverwise Standard application, there is a query where travelers are required to provide information on whether they have suffered a medical condition that needed prescribed medicine over the last 5 years. Those who fill in that they have had a medical condition in the policy are automatically upgraded to Coverwise Select.

Notably, Taylor’s policy simply states that claims emanating from pre-existing medical conditions are not covered. Despite her kidney tumor having had no connection to her previous insomnia, Axa remain insistent that she is disqualified from probable claims because of her omission.

The company mentioned that they had carried out retrospective medical screening using the right sister policy. Afterwards, they agreed to pay a substantial amount for the claim in accordance with the cost she incurred in her initial policy.

Small Print

Most basic policies exclude travelers from getting compensated in situations where they end up breaking their legs on the tiles; when airlines go bust; or like in Taylor’s case, when travelers fail to declare existing minor medical conditions

In recent years, there has been a proliferation of comparison websites that encourage holidaymakers to pick the cheapest option among them. While this is an excellent business strategy, many travelers have not been keen enough to read through the small print which is full of exclusions and limitations. Hence, most end up unable to get their claims after the unexpected occurs.

As revealed by the Financial Ombudsman Service, travel insurance an be a tricky topic for individuals to navigate at any time of the year because of the numerous risks covered. Incidentally, most people continue to view travel insurance as a last minute “add-on” for the holiday.

Typically, single-trip policies insure customers from the date of purchase. Because of this, those buying the annual cover have to nominate a start date for the policy to take effect. Those who cancel trips before that are automatically ineligible to claim a refund.

As the Financial Ombudsman Service details, most people try to get the most out of their cover by picking a start date that aligns with they day they plan to fly out. However, they suggest that this school of thought is flawed since one is locked out of the cancellation cover.

More inCar Insurance

-

`

10 Valuable Career Lessons for the 20s That Pay Off in Your 30s

Entering your 30s often feels like a moment of reflection. For many, it’s a time when you realize how much the...

February 8, 2025 -

`

Auto Industry’s Ongoing Disruption – What’s Changing?

The auto industry is undergoing rapid change, with several key factors reshaping its future. A recent report by PwC highlights significant...

February 1, 2025 -

`

How to Safely Drive Away from Wildfires – Essential Tips

Wildfires are unpredictable and dangerous, often spreading rapidly with little warning. A video from the Los Angeles wildfires showed abandoned cars...

February 1, 2025 -

`

Can Your Car Keep You Safe During an Emergency?

Natural disasters such as wildfires, hurricanes, and floods can occur unexpectedly, leaving little time to prepare. In such situations, your car...

January 25, 2025 -

`

Tesla Reveals 2025 Model Y Juniper – Here’s What’s New!

Tesla has revealed the 2025 Model Y Juniper, a refreshed version of its best-selling electric SUV. This update enhances design, comfort,...

January 25, 2025 -

`

How to Check Transmission Fluid for Optimal Car Performance

Maintaining your vehicle’s transmission is just as essential as other routine car maintenance tasks like oil changes or tire rotations. Knowing...

January 18, 2025 -

`

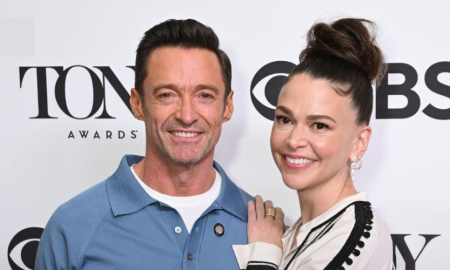

Sutton Foster and Hugh Jackman Spark Romance on L.A. Date Night

Hollywood is abuzz with the latest photographs of Hugh Jackman and Sutton Foster, who appear to be confirming their romance during...

January 16, 2025 -

`

How to Fix Car Window Off-Track and Align It Properly

When your car window gets stuck or misaligned, it’s often due to an off-track issue. Learning how to fix car window...

January 10, 2025 -

`

How to Drive a Stick Shift: A Quick Guide for Manual Beginners

Driving a stick shift requires coordinating the clutch, brake, and accelerator to control a car with a manual transmission. Manual cars...

January 3, 2025

You must be logged in to post a comment Login