Should I Rebalance My Portfolio Alone or Seek Professional Help?

Managing investments requires a well-planned strategy, especially when nearing retirement. Many investors wonder whether they should handle portfolio rebalancing on their own or seek professional guidance.

While some prefer the control of a do-it-yourself (DIY) approach, others recognize the benefits of working with an expert. The right choice depends on financial knowledge, discipline, and the ability to follow a structured plan.

The Importance of Rebalancing a Portfolio

Instagram | seriktrades | Rebalancing keeps investments on track for success

Over time, market fluctuations cause portfolio allocations to shift, leading to unintended risks. Rebalancing ensures that investments stay aligned with financial goals and risk tolerance. However, many investors struggle to make adjustments, especially during market downturns. Fear of losses often prevents them from selling high-performing assets or buying those that appear to be struggling.

Without rebalancing, a portfolio can become overly concentrated in certain assets, increasing exposure to market volatility. This imbalance can disrupt long-term financial planning and make it harder to achieve retirement goals.

Challenges of Managing a Portfolio Independently

1. Emotional Decision-Making

Managing a portfolio independently requires discipline, but emotions often lead to impulsive decisions. Fear and greed can cause investors to sell too soon or hold onto losses.

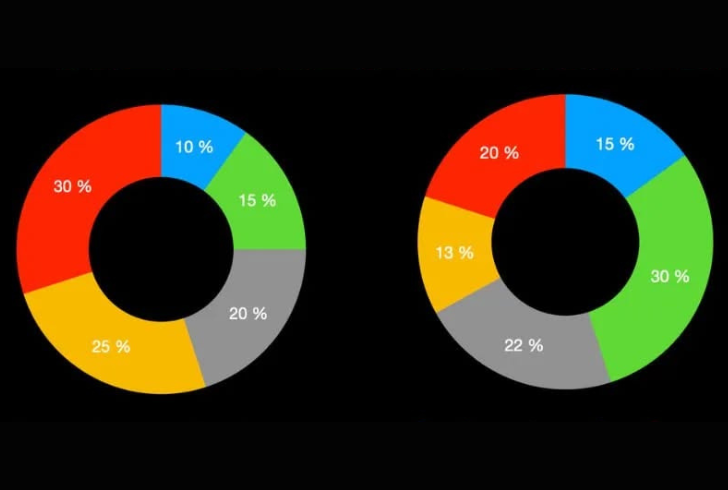

Why Working With a Professional Can Be Beneficial

A portfolio manager brings expertise and objectivity, helping investors stay on track with long-term financial goals. Many professionals follow a structured strategy that removes emotions from investment decisions. Their disciplined approach ensures that rebalancing happens when necessary, even during uncertain market conditions.

Freepik | Portfolio managers balance risk and return, adjusting investments for economic stability.

Portfolio managers also provide risk assessment, helping investors maintain a balance between high-risk and low-risk investments. They make adjustments based on financial objectives, ensuring stability during economic fluctuations. Additionally, working with a professional saves time, allowing investors to focus on other priorities without worrying about daily market changes.

Behavioral Finance Role in Investment Decisions

Many investors know they should rebalance their portfolios but hesitate when faced with actual market movements. Behavioral finance studies have shown that fear, overconfidence, and loss aversion influence financial decisions more than logic. Even when presented with sound investment strategies, some investors fail to act due to psychological biases.

Choice architecture, a concept that focuses on structuring decisions in a way that encourages better choices, has gained traction among financial professionals. By guiding investors toward disciplined investing, portfolio managers help clients avoid common behavioral pitfalls and improve long-term financial outcomes.

Making the Right Choice for Financial Success

Deciding whether to rebalance a portfolio independently or with professional help depends on personal circumstances. Investors with strong financial knowledge and emotional discipline may prefer a DIY approach. However, those who struggle with decision-making, market analysis, or time constraints may benefit from expert guidance.

Regardless of the approach, maintaining a well-balanced portfolio is essential for long-term financial success. Whether managing investments alone or working with a professional, investors must remain committed to a strategy that aligns with their goals and risk tolerance.

More inAdvice

-

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025 -

`

Florida Auto Insurance Rates Finally Drop. But for How Long?

After years of rising premiums, Florida drivers are finally seeing lower auto insurance rates on the horizon. For 2025, the state’s...

August 15, 2025

You must be logged in to post a comment Login