How to Handle Car Insurance for Your Teenage Driver

So, your teenage child finally got their driver’s license and is excited about driving your car. It is understandable that this might be a nerve-wracking time for you as the parent, especially when it comes to car insurance.

Teenage drivers are generally considered high-risk drivers, so insurance companies charge a higher premium for them. However, with some effective tips, you can manage car insurance for your teenage driver without breaking the bank.

This brief blog provides you with some practical tips that will help you navigate the world of car insurance for your teenage child.

Ketut / Pexels / While it is hard to hand your car keys to your teenage son or daughter, you can actually take care of it with sensibility.

Shop Around

The first tip to manage car insurance for your teenage driver is to shop around. Different insurance companies offer different quotes. So, it is essential to compare the rates and coverage options. You can ask for quotes from multiple companies and compare them to find the best deal. You can also use online insurance comparison tools that make it easier to compare multiple quotes at once.

Add Them to Your Policy

Adding your teenage child to your existing car insurance policy is another effective way to manage car insurance costs. Adding them to your policy could help you save money on car insurance premiums.

However, it is worthwhile to inquire with your insurance company since some companies may offer better rates if your teenage driver has their own separate policy.

Kampus / Pexels / First thing first: Before you hand over your car keys to your teenage son or daughter, make sure to get the best insurance deal by shopping around.

Encourage Safe Driving

Safe driving is critical, and it can have a significant impact on your child’s car insurance premiums. Encourage your teenager to be a responsible driver, obey traffic rules, and avoid any risky behavior.

A clean driving record can help reduce the cost of car insurance. Additionally, the defensive driving course might be a good way to reduce insurance costs and educate new drivers about safe habits behind the wheel.

Choose the Right Car

It is crucial to choose the right car for your teenage driver, especially if you are looking to save money on car insurance. Insurance companies generally charge higher premiums for luxury cars or high-performance vehicles.

So, consider getting a car that is safe, reliable, and inexpensive. These will help you cut down insurance costs. At the same time, it will give you peace of mind knowing that your child is in a safer car.

Dids / Pexels / To get the best car insurance and safe driving, encourage your teenager to drive carefully.

Raise Your Deductible

Raising your deductible is another effective way to manage car insurance costs. The deductible is the amount you pay out-of-pocket before your car insurance kicks in. If you raise your deductible, your insurance premiums will be lower. However, make sure you can afford to pay a higher deductible in case of an accident.

Parting Thoughts

Managing car insurance for your teenage driver does not have to be stressful. By following these handy tips, you can effectively manage car insurance costs and ensure that your teenage driver is well-protected on the road.

Remember to drive safely and be mindful of your policy limits and deductibles when choosing coverage for your child. This way, you can help your teenage drivers be safe and responsible drivers on the road.

More inCar Insurance

-

`

Mercedes-Benz Cuts Costs, Prioritizes Combustion Engines for Profit Boost

The automotive landscape is shifting, and one major player is recalibrating its strategy to navigate the evolving market. In a bid...

March 8, 2025 -

`

The Hidden Downsides of Delaying Social Security Until 70

Many people are told to hold off on claiming Social Security until they reach 70 to receive the highest possible monthly...

March 8, 2025 -

`

Will Louisiana’s Car Insurance Crisis Get Worse Due to Tariffs?

Tariffs often impact industries in unexpected ways, and Louisiana’s car insurance market might face new challenges because of them. Although most...

March 2, 2025 -

`

Is Tesla’s Self-Driving Software Safe? Cybertruck Crash Raises Doubts

A recent Tesla Cybertruck accident has sparked concerns about the company’s self-driving technology. The incident occurred in Reno, Nevada, when a...

March 2, 2025 -

`

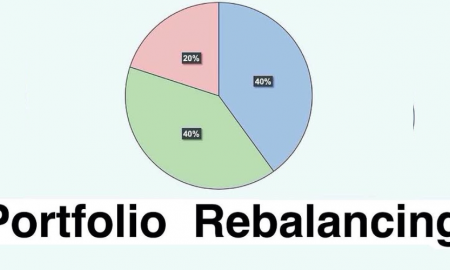

Should I Rebalance My Portfolio Alone or Seek Professional Help?

Managing investments requires a well-planned strategy, especially when nearing retirement. Many investors wonder whether they should handle portfolio rebalancing on their...

February 22, 2025 -

`

Auto Industry Faces More Challenges in 2025, Experts Warn

The auto industry is heading toward a challenging 2025, with multiple factors reshaping its landscape. Tariff threats, rising costs, and obstacles...

February 22, 2025 -

`

Car Insurance Rates Surge Across 5 States – Are You Affected?

Car insurance rates have surged dramatically across the U.S., with some states experiencing historic increases in 2024. Minnesota and Maryland have...

February 15, 2025 -

`

Elon Musk Admits Tesla’s Self-Driving Hardware Needs an Upgrade

For years, Elon Musk has confidently stated that Tesla vehicles had the necessary hardware to achieve full autonomy. However, in a...

February 15, 2025 -

`

10 Valuable Career Lessons for the 20s That Pay Off in Your 30s

Entering your 30s often feels like a moment of reflection. For many, it’s a time when you realize how much the...

February 8, 2025

You must be logged in to post a comment Login