How to Save on Tesla Car Insurance Without Compromising Coverage

Owning a Tesla often brings savings on fuel and a futuristic driving experience, but the conversation changes quickly when it comes to car insurance. Premiums can be surprisingly high—thanks in large part to the unique features, repair costs, and technology that set Tesla vehicles apart. So while you may avoid gas station stops, budgeting for insurance deserves just as much attention.

If you’re trying to understand how Tesla Insurance works and whether it’s the right option for your electric ride, here’s what you need to know—along with how to compare plans and make sure you’re not overpaying.

What Is Tesla Insurance?

Tesla rolled out its own insurance in 2019, starting with California. Since then, it has expanded into a dozen states, offering comprehensive and customizable coverage directly through the Tesla app.

What’s covered?

Tesla Insurance includes all the essentials—liability, collision, comprehensive, personal injury protection, and uninsured/underinsured motorist coverage. Optional add-ons like rental reimbursement, roadside assistance, and gap coverage are also available.

Quotes can be generated directly in the app, and policyholders can handle claims and updates without speaking to an agent. For new Tesla orders, quotes can be generated as soon as the VIN and delivery date are available.

In select states, Tesla Insurance is also available to non-Tesla vehicle owners.

Where Tesla Insurance Is Available

Instagram | @biginsurancenews | Tesla adjusts your insurance cost based on how safely you drive each month.

As of now, Tesla offers insurance in the following states:

– California

– Texas

– Arizona

– Nevada

– Illinois

– Ohio

– Oregon

– Utah

– Virginia

– Maryland

– Colorado

– Minnesota

Availability could grow, but for now, these are your options if you’re considering going direct with Tesla.

How Tesla’s Real-Time Insurance Works

One of the key differences with Tesla Insurance is its “Real-Time Insurance” model. Instead of relying only on your driving history and demographics, Tesla pulls data directly from your vehicle to evaluate how you drive.

Each month, Tesla recalculates your rate based on a “Safety Score.” This score takes into account the last 30 days of driving behavior. Good scores and low mileage can lead to lower monthly payments, while riskier habits might raise your premium.

Factors that affect the Safety Score include:

Frequent hard braking, Sharp turns, Tailgating, Night driving (11 p.m. to 4 a.m.), Driving without a seatbelt, Autopilot disengagement due to inattentiveness.

This data-driven approach doesn’t apply in California due to state regulations, though Safety Scores can still be viewed in the app without impacting your rate.

What Impacts the Cost of Tesla Insurance?

Tesla’s model and real-time data are only part of the story. Here are other key factors:

1. Model type and trim – More advanced or expensive models (like the Model X or Model S) usually come with higher premiums.

2. Location – Rates can differ based on your ZIP code, especially if your area sees high accident rates or theft.

3. Coverage level – Full coverage including collision and comprehensive costs more than basic liability.

4. Driving behavior – The Safety Score has a direct influence on your monthly costs in most states.

Discounts Available Through Tesla Insurance

Discounts are offered, but availability depends on the state. Some examples include:

Airbag discount – Offered in Nevada for cars with certain airbag setups.

Anti-theft device discount – Available in Illinois and Minnesota.

Defensive driving – Drivers over 55 (or 60 in Ohio) can take a certified course to earn savings.

Full Self-Driving (Supervised) discount – If more than half your driving uses Tesla’s supervised FSD, you may qualify (available in Texas and Arizona).

Elite driver and good driver – California residents can receive automatic discounts based on their clean driving history.

Multi-car and group discounts – Provided in all participating states, including options for Tesla employees.

How It Compares to Other Providers

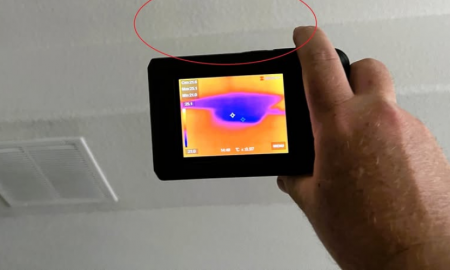

Image by Carjets | Tesla insurance works well for drivers but may not save more than bundled plans.

Other major insurers like State Farm, GEICO, and Progressive also insure Teslas. While Tesla Insurance may offer convenience and dynamic pricing, other companies might offer bundling deals—such as combining auto and homeowners insurance—that Tesla currently doesn’t support.

For those drawn to behavior-based pricing, usage-based insurance programs from other companies (like State Farm’s Drive Safe & Save) work similarly to Tesla’s real-time system. However, keep in mind that not all programs offer reduced rates—some can raise premiums if your driving patterns fall short.

Steps to Shop Smart for Tesla Insurance

1. Know what you need

Understand your state’s insurance requirements, then assess if additional coverage like comprehensive or collision fits your needs.

2. Compare multiple quotes

Even if Tesla Insurance is available, it’s wise to get quotes from at least three providers to evaluate cost and coverage side-by-side.

3. Think beyond the car

If you own a home, factor in the value of insurance bundles that Tesla doesn’t offer.

4. Ask around

Online forums and other Tesla owners can offer insight into real-life experiences with premiums, claims, and Safety Score challenges.

5. Choose based on fit

The best policy balances price, service quality, and how much control you want through technology or human agents.

Is Tesla Insurance Worth It?

Tesla Insurance brings innovation and convenience to a space that hasn’t changed much in decades. While the monthly pricing model based on real-time data is appealing, especially for careful drivers, it won’t be the best fit for everyone—particularly in areas with high traffic or inconsistent driving conditions.

Before locking in a policy, take time to explore all your options. With the right comparison strategy, it’s possible to enjoy all the benefits of owning a Tesla without overspending on coverage.

More inAdvice

-

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025 -

`

Florida Auto Insurance Rates Finally Drop. But for How Long?

After years of rising premiums, Florida drivers are finally seeing lower auto insurance rates on the horizon. For 2025, the state’s...

August 15, 2025

You must be logged in to post a comment Login