Do Car Insurance Companies Offer Pay-As-You-Go Plans?

Car insurance premiums often feel unfair to people who rarely drive. Yet, most traditional auto policies still charge a fixed monthly rate regardless of mileage. That’s where pay-as-you-go car insurance comes in. Designed with low-mileage drivers in mind, this modern approach ties your costs directly to how much you drive, making it a more tailored, and often more affordable, option.

This article explores how pay-as-you-go insurance works, who benefits from it most, and what coverage you can expect.

Understanding Pay-As-You-Go Coverage

Instead of charging a flat rate each month, pay-as-you-go car insurance calculates part of your premium based on miles driven. The formula is simple: you pay a base rate — which is determined by your age, driving history, and car type — plus a small charge for each mile.

To track your mileage, insurers use telematics. That means either a device plugged into your vehicle or a smartphone app tracks your driving in real time. The system automatically submits your mileage to the insurance provider, making billing more accurate and timely.

Unlike standard plans, this one adapts as your driving habits change. If you drive less this month, you pay less this month. It’s that straightforward.

What Does It Cover?

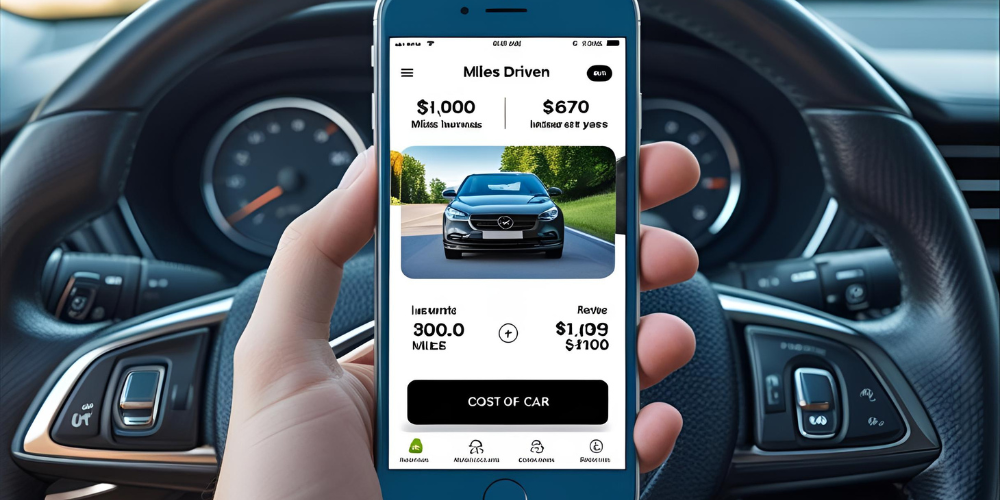

Image generated by canva Ai | Drivers can pay less each month with insurance that adjusts to how many miles they drive.

Pay-as-you-go insurance covers the same essentials as standard auto policies. You won’t miss out on key protections.

It typically includes state-required minimums for liability coverage, both bodily injury and property damage. In most cases, you can also add comprehensive and collision coverage for added protection, especially if your car is newer or financed. Depending on the provider and location, extra options like uninsured motorist coverage or personal injury protection (PIP) may also be available.

So even though you’re paying differently, the level of protection stays strong.

What’s Not Included?

Like any insurance, pay-as-you-go policies have limits. They generally don’t cover wear and tear from everyday use, or intentional damage. If you use your car for business or rideshare services, your policy may not apply unless you’ve arranged a commercial endorsement.

Also, personal belongings left in your car aren’t protected under these plans. If your laptop or phone gets stolen from your vehicle, your renters or homeowners insurance might help, but your auto plan won’t. Only listed vehicles are covered, so don’t forget to add a new car if you buy one.

Cost Breakdown: Is It Cheaper?

Here’s how the math works. Assume that your monthly base rate is $60 and that your per-mile fee is 7 cents. If you drive 500 miles in a month, you’d owe $35 in variable charges. That brings your total to $95. But if you only drive 100 miles, you’d pay just $67.

Whether that saves you money depends on your usual mileage. According to insurance industry data, the average minimum coverage policy costs approximately $52 per month. If you do not drive frequently, pay-as-you-go may be less expensive. In fact, providers like Mile Auto say low-mileage users can save 30% to 40% compared to standard plans.

Who Should Consider Pay-As-You-Go?

This model works best for people who aren’t in their car all the time. That includes:

1. Remote workers logging fewer miles

2. Retirees who only drive occasionally

3. Students who leave their cars parked on campus

4. Families with a second vehicle that is used sparingly

If you drive less than the national average of 12,000 miles per year, chances are you’ll come out ahead.

Perks That Go Beyond the Price

Aside from potentially lower costs, these plans offer some welcome extras. Many companies let you manage everything through a user-friendly app, including mileage tracking and billing. You may also get driving feedback or score-based discounts.

Some providers, such as Hugo, offer nearly instant sign-up and transparent pricing. Others, like Nationwide, reward safe drivers with extra discounts — often up to 10% when your policy renews.

These perks add value and convenience, making it easier to keep your coverage current and customized.

Popular Pay-Per-Mile Providers

While availability varies by state, several well-known companies now offer pay-as-you-go policies. These include:

1. Allstate (Milewise)

2. Nationwide (SmartMiles)

3. Metromile

4. Mile Auto

5. Hugo

Each program has its own pricing structure and tech, but they all serve the same purpose: helping low-mileage drivers save money without sacrificing coverage.

How to Apply for Pay-As-You-Go Coverage

Freepik | Frolopiaton Palm | Drivers can apply in minutes after comparing quotes and choosing the right mileage-based plan.

The first step is comparing quotes. Contact three to five insurers, or use an online marketplace to save time. You’ll need to share some details — your vehicle, estimated mileage, driving history, and address — to receive accurate pricing.

Once you’ve found a good fit, the signup process is usually quick. After activating your account, the insurer will send a telematics device or guide you through installing their app.

Be sure to ask about any available discount opportunities, whether there are mileage caps, how frequently you’ll be billed, and what the process looks like if you need to pause or cancel the policy due to changes in your driving habits. Getting clarity on these points upfront can help you avoid hidden fees or unexpected surprises down the road.

Why Less Driving Should Equal Lower Costs

Traditional insurance doesn’t reward safe, infrequent drivers. But pay-as-you-go models shift the power — and savings — back to the driver. If your time on the road is limited, this type of plan lets your wallet reflect that. It’s flexible, transparent, and designed with today’s lifestyle in mind.

Whether you’re working from home, commuting less, or using your car sparingly, it pays to explore options tailored to your actual habits. Saving money on car insurance may be just a few miles—or fewer — away.

More inCar Insurance

-

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025 -

`

Florida Auto Insurance Rates Finally Drop. But for How Long?

After years of rising premiums, Florida drivers are finally seeing lower auto insurance rates on the horizon. For 2025, the state’s...

August 15, 2025

You must be logged in to post a comment Login