Giving Your Car Away? Check Out These Worthy Charities

Charities use donated cars to transport people and haul goods. If you have a vehicle that you are no longer using, consider donating it. Nonetheless, there have been many cases where donated cars are sold to raise capital. The sales are either handled by the charity itself or a dealer. In the case of a dealer, the sales could fall to as little as $45 for a vehicle from the car donation.

If you decide to donate your car for whatever reason, you should follow the tips below to comply with the regulations of the IRS. They are particularly important because any tax deductions for making a car donation will be limited to the price at which the charity sells the car.

Important Aspects To Follow When Donating A Car

Tax Deduction

Tax Deduction

You should focus on receiving the maximum tax deduction for the car donation. Also, you should ensure that you feel satisfied that the entire value of the car is beneficial to the intended charitable cause. Therefore, it is advisable to donate the car directly to the charity or to hand it over to an individual in need. Otherwise, your tax deduction will be limited to the money the charity receives from the sale of the car, which will not be calculated according to the car’s fair market value. You should also inquire from the intended charity to understand whether they are going to sell the vehicle. If so, what percentage of the proceeds do they expect to receive?

Maximum Proceeds

Maximum Proceeds

Ask the charity whether they are willing to accept car donations directly without the involvement of a third party. If they do, drive the car to the charity yourself instead of towing or using a pickup service. That way they will keep the full value from the proceeds they receive from selling the car.

Eligibility

Eligibility

Ensure the charity is eligible to receive tax-deductible contributions. Also, obtain a copy of the letter from the IRS which confirms the tax-exempt status of the charity. When you donate your car, you must obtain a receipt from the charity.

The IRS often targets non-cash relations for an audit. Therefore, it is advisable to have the car evaluated and also keep the records of the evaluation with you.

Tax Liabilities For Making A Car Donation

You cannot give a car donation without any paperwork. If your car is valued at over $500, you have to complete section B of IRS form 8283. If the value of the car is less than $5000, you can use a guide from the national auto dealers Association for the evaluation of your car. You must also record the exact figure for the date, mileage and the overall condition of your car. Do not make the mistake of picking the highest value for your car without considering other factors which may not be approved by the IRS.

You must also record the exact figure for the date, mileage and the overall condition of your car. Do not make the mistake of picking the highest value for your car without considering other factors that may not be IRS-approved.

Furthermore, you should have pictures of the car and receipts of any new tires and upgrades you may have made. This will help you to verify the value of the car.

Most importantly, keep in mind that it is your responsibility and not that of the charity to have the car evaluated. If the IRS requires a proof of the figure quoted, you will be liable to pay penalties.

When you decide to donate a car, ensure that you follow these points. Trying to take an alternate route can get you in trouble, which will make you wish you were better off leaving the car in your garage instead.

More inCar Insurance

-

`

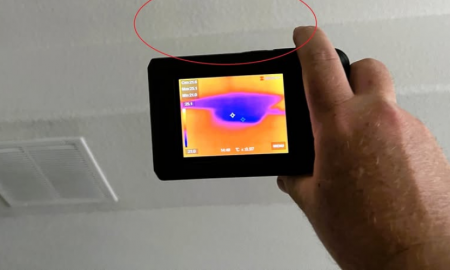

Expert Tips for Protecting Your Home From Natural Disasters

Preparing for natural disasters rarely tops anyone’s weekend to-do list. Yet, with unpredictable weather becoming more common, protecting a home against...

October 17, 2025 -

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025

You must be logged in to post a comment Login