Aiming for a Cheaper Insurance Premium? Why Voluntary Excesses Might Not be The Way to Go

People are always looking to minimize how much car insurance premiums they pay on a monthly basis. One popular method is to purchase a higher voluntary excess.

How does the higher voluntary excess work?

Let’s look at voluntary excess like a bet. In fact, you’re betting on the likelihood that you won’t make a claim by being a careful driver. So if you avoid getting involved in an accident, it might be quite convenient to access this option.

By doing this, the voluntary excess decides how much you will be paid when you decide to make a claim.

That being said, when you pay for a higher excess the first time around, your premiums are usually reduced. However, did you know that this method could actually result in you paying more over time?

In fact, opting to utilize a higher voluntary excess is a gamble in itself. That’s because you will only be paid in the event that you, unfortunately, get an accident.

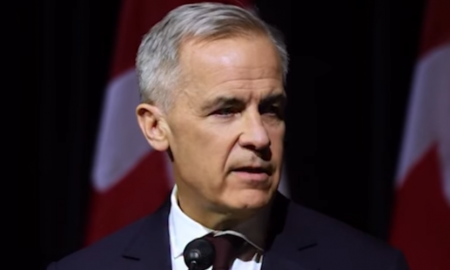

In a bid to reduce insurance premiums, drivers are opting for voluntary excesses

Not as enticing as it looks

That being said, if you happen to be involved in an accident, you could end up paying more money than what you would have had you opted to purchase the premium.

Indeed, an investigation spearheaded by Moneywise Magazine showed that drivers that took the higher voluntary excess route actually ended up paying just as much, if not more, than the individuals who did select regular premiums.

The magazine sampled insurance premiums for 50 and 30-year-old Ford focus drivers in areas in South London, Leeds, and Aberystwyth.

Additionally, the magazine ran different quotas for drivers paying no money, 250 pounds, and in excess of 500 pounds.

Their results were staggering. In some instances, the case study showed that the excess would be much higher than paying the premium!

Despite their enticing nature, voluntary excesses might end up being more expensive in the long run

Analyzing the study deeper

One fine example during the study was that of a resident of Aberystwyth, 30 years of age. The specific individual ended up increasing their voluntary excess from zero to 500 pounds. In turn, their overall premium was brought to 37 pounds.

Interestingly, this would mean that the resident would have to pay an additional 385 pounds any time they were involved in an accident.

Analyzing the case of the driver aged 50, if he opted for an excess of 500 pounds, this means he would end up paying $495 as the premium. Additionally, if he opted for an excess of 250 pounds, the driver would only need to pay one pound more!

Expert’s view on excesses

One of the spokesmen for car insurance company Hastings commented on this structure, stating that despite these fluctuations, choosing a higher voluntary excess will often lead to a reduction in the insurance premium.

On the other hand, the voluntary excess is dependent on the data and information provided during when the vehicle and driver are being screened during the quote process.

The chief spokesman for Association of British Insurers, Malcolm Tarling, commented on voluntary excess, stating that an individual who paid an excess somewhat close to the average premium would not see a major increase in their savings. However, he did acknowledge that the excess could affect drivers differently depending on the kind of vehicles that were being used.

Aiming for lower insurance premiums

That being said, here are a number of ways that you can lower your car insurance premiums without betting on your ability to not make a claim!

- Select a vehicle that is affordable to run. For example, if you happen to have an increased car insurance group, it’s a given that your premium will be much higher.

- Go the extra mile by ensuring that the current vehicle you have has state-of-the-art security systems that minimize the chances of an accident

- Be transparent about the people that have access to your vehicle (e.g family members, friends)

- Describe in detail to your insurance provider the ways in which you utilize your vehicle.

- When filing your details, ensure to be accurate with the ways in which you use your car, for example, the mileage and the type of cover that you have

Moreover, you have to keep in mind that cars that have been imported by private dealers tend to be much more expensive to secure as compared to local brands.

More inCar Insurance

-

`

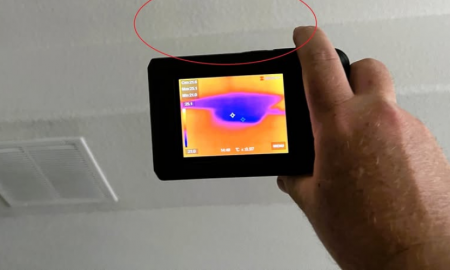

Expert Tips for Protecting Your Home From Natural Disasters

Preparing for natural disasters rarely tops anyone’s weekend to-do list. Yet, with unpredictable weather becoming more common, protecting a home against...

October 17, 2025 -

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025

You must be logged in to post a comment Login