Why Car Insurance is Going Up in the U.S.

Car insurance, like everything else, suffered a jolt during the pandemic. With a significant rise in the number of accidents, claims went through the roof, leading to rising costs for insurers and skyrocketing premiums for car owners. According to a report by ValuePenguin, auto insurance costs in the U.S. rose by almost 5% in 2020 – and there seems to be no respite in sight moving forward.

In this blog post, we will explore the reasons behind the surge in prices and the steps you can take to bring them down.

Understanding the Reason Behind the Spike in Car Insurance Rates

The pandemic caused insurance companies to increase prices, but why? One of the reasons is that driving patterns have changed drastically. With remote workspaces and remote learning, fewer people are driving to school or work. But an increasing number of people are driving to distant areas: Vehicles logged more miles traveled almost every day, leading to an increase in accident claims.

Andrea / Pexels / According to a recent survey, 63% of Americans are worried about their car insurance.

This led to fewer clients being insured, decreased profits for car insurance companies, and justified the price hike.

Shopping Around for the Best Policy

It is time to brush up on your bargaining skills to strike the best deal when shopping for car insurance. It is essential to take your time and analyze the options offered by different insurance providers. Do not be afraid to compare prices and coverage from at least five providers before settling on one.

One bonus tip: Several online providers, such as Policygenius and Gabi, help you compare rates from different providers. This not only saves you time but also offers you the best rates. So, keep in mind that the cheapest option may not always be the best.

Mikhail / Pexels / To overcome car insurance spikes, you will have to understand the reasons behind them.

Use Your Credits or Employer Discounts

Personal factors, including credit scores, can impact the rates you pay for your car insurance. Therefore, before shopping for a policy, it helps to keep your credit score in check. Maintaining your credit score gives you a better chance of securing discounts and getting affordable rates.

Furthermore, some companies offer discounts to their employees. So, it Is essential to check your employment benefits.

Bundle Up

Several insurance companies offer discounts when customers bundle their car insurance with home and life coverage. This not only entitles you to savings but also streamlines claims processes since all coverages are under one provider.

So, if you have multiple insurance needs, bundling them all together can save you a chunk of money.

Andrea / Pexels / Whenever possible, use your employment discounts and credits. And don’t forget to maintain your credit score.

Check for Every Possible Discount

The insurance industry has a variety of discounts that can reduce your car insurance premium. Some of the most common are good driving discounts, usage-based discounts, and loyalty discounts.

Therefore, it is essential to discuss all possible discounts with your provider to shave off every penny possible from your car insurance costs.

So, car insurance rates are surging in the U.S., and the factors driving this hike are clear. Understanding these reasons and taking steps to get the best coverage at the most reasonable rates is imperative. By shopping around for policies, checking any available discounts, and bundling coverage, you can get the best deal possible.

At the same time, maintaining your credit score and driving sensibly are two easy ways to save a lot of money in the long run. Remember, the cheapest option may not be the best. Therefore, take your time, compare policies, engage with your provider, and make an informed decision to save money on car insurance premiums.

More inCar Insurance

-

`

Trump’s Tariffs Could Cause a Spike in Car Insurance Prices in 2025

Car insurance premiums have already been rising, and 2025 may bring even higher costs for drivers. President Donald Trump’s proposed import...

March 15, 2025 -

`

Tesla Files for Ride-Hailing Service in California, Featuring Human Drivers

Tesla has taken a new step in the ride-hailing industry by applying for a permit to operate a human-driven service in...

March 15, 2025 -

`

Mercedes-Benz Cuts Costs, Prioritizes Combustion Engines for Profit Boost

The automotive landscape is shifting, and one major player is recalibrating its strategy to navigate the evolving market. In a bid...

March 8, 2025 -

`

The Hidden Downsides of Delaying Social Security Until 70

Many people are told to hold off on claiming Social Security until they reach 70 to receive the highest possible monthly...

March 8, 2025 -

`

Will Louisiana’s Car Insurance Crisis Get Worse Due to Tariffs?

Tariffs often impact industries in unexpected ways, and Louisiana’s car insurance market might face new challenges because of them. Although most...

March 2, 2025 -

`

Is Tesla’s Self-Driving Software Safe? Cybertruck Crash Raises Doubts

A recent Tesla Cybertruck accident has sparked concerns about the company’s self-driving technology. The incident occurred in Reno, Nevada, when a...

March 2, 2025 -

`

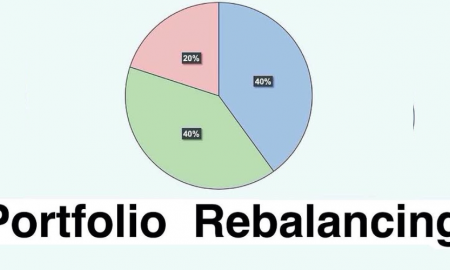

Should I Rebalance My Portfolio Alone or Seek Professional Help?

Managing investments requires a well-planned strategy, especially when nearing retirement. Many investors wonder whether they should handle portfolio rebalancing on their...

February 22, 2025 -

`

Auto Industry Faces More Challenges in 2025, Experts Warn

The auto industry is heading toward a challenging 2025, with multiple factors reshaping its landscape. Tariff threats, rising costs, and obstacles...

February 22, 2025 -

`

Car Insurance Rates Surge Across 5 States – Are You Affected?

Car insurance rates have surged dramatically across the U.S., with some states experiencing historic increases in 2024. Minnesota and Maryland have...

February 15, 2025

You must be logged in to post a comment Login