Do Future Vehicles Need Insurance?

As electric vehicles are becoming more affordable, auto insurers need to encourage safe driving and reward drivers who exercise safety habits. One tool that is a game changer for auto insurers is telematics data. By tracking data, telematic insurance companies can assess accidents and driving behaviors of drivers and provide value for customers.

How a vehicle is operated now dictates how insurance can price products. The future lies in deciding how to make it less correlative and more casual.

Loe/Pexels | Tracking data from insurance companies’ accidents can be assessed

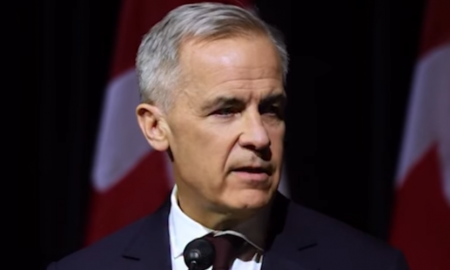

Andrew Rose and the future of the insurance industry

Andrew Rose said that he joined GM financial for the data as it provides the chance to be transformative. He said that they have been collecting data for 25 years at OnStar. Data can be used for insurance cases, whether it is for segmentation, pricing products, finding the drivers, and guiding them about following the safety rules. Through data, this can also be analyzed when an accident has occurred and what parts are broken, if a vehicle completely messed up about the injuries the individual may have got.

All these things are possible under the umbrella of OEM. Very little data is being used at present for pricing, underwriting, and claims. The average manufacturing data of a vehicle available is from the year 2011. As technology starts coming down the road, insurers can use the data to transform the future. The vehicle data is expected to transform the safety of the people and the insurance industry.

Artyom/Pexels | Accidents can be minimized by rewarding people for good road behavior

People also wonder what the future of insurance will turn out to be. According to the GM standpoint, the realization of zeros refers to zero emissions, zero congestion, and zero crashes. Other drivers understand what is happening on the road and assist and guide better. The insurance companies want to take the ADAS(advanced driver-assistance systems) to the next level.

Through this, you can also find out who is responsible for the accident. OEMs have this opportunity to create an insurance ecosystem in a way we can’t even imagine. Access to this information will give access to an understanding of the vehicles coming and the data from the vehicles. The brand will be important as it will link the auto and auto insurance environments in the future.

Andrea/Pexels | Insurers can use the data to transform the future

Andrew Rose hopes to supply data to the insurance ecosystem as General Motors with zero crashes as the goal. From this standpoint, Rose would be rewarding good road behavior. Whether insurance is from OnStar insurance or any other company, we expand the benefits and value of it. He also added that integrated embedded insurance is the future.

To rethink pricing, a way has to be devised to combine data from vehicles with how the driver behaves about the claim data. How will this happen? Andrew Rose replied that the system is getting better, but now we have a chance to acquire sophisticated telematics data. After an accident, the data will help us analyze all the details related to the accident and also who is harmed most by it.

More inCar Insurance

-

`

Tesla’s FSD Software Under Investigation After Railroad Incident

Federal regulators have begun a sweeping review of Tesla’s Full Self-Driving software. The National Highway Traffic Safety Administration (NHTSA) announced a...

October 24, 2025 -

`

Expert Tips for Protecting Your Home From Natural Disasters

Preparing for natural disasters rarely tops anyone’s weekend to-do list. Yet, with unpredictable weather becoming more common, protecting a home against...

October 17, 2025 -

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025

You must be logged in to post a comment Login