Does Your Auto Insurance Cover Medical Expenses in Accidents?

Car accidents can lead to a range of unexpected challenges, from vehicle repairs to hospital visits. One of the most significant concerns is the financial burden of medical expenses after an accident. Whether it’s a minor collision or a severe crash, having the right insurance coverage can make a world of difference. Medical payments coverage, often referred to as MedPay, can help safeguard you from overwhelming bills, offering financial relief regardless of who is at fault.

What Is MedPay and How Does It Work?

Freepik | v_l | MedPay, an optional auto insurance coverage, reimburses medical expenses incurred in accidents.

Medical payments coverage (MedPay) is an optional add-on to your auto insurance policy that covers medical expenses resulting from an accident. This type of coverage is particularly beneficial as it pays for costs incurred by you, your passengers, or even pedestrians injured in the incident.

MedPay stands out because:

1. It applies irrespective of who is at fault in the accident.

2. It can cover out-of-pocket costs not addressed by health insurance, like copays and deductibles.

3. It extends coverage to scenarios like ambulance services, hospital visits, and rehabilitation.

However, it’s essential to note that MedPay is not a substitute for comprehensive health insurance. It primarily serves as supplemental coverage to fill gaps that your health insurance might leave.

MedPay vs. Bodily Injury Liability Coverage

While MedPay focuses on covering your own medical expenses, bodily injury liability coverage serves a different purpose. This type of coverage is often mandatory and is included in most auto insurance policies. Its primary function is to pay for the medical expenses of others if you are at fault in an accident.

Key Differences:

1. MedPay – Covers your medical expenses and those of your passengers, regardless of fault.

2. Bodily Injury Liability – Covers medical costs for other parties injured in an accident you caused.

For instance, if you cause an accident that results in injuries to another driver, bodily injury liability coverage will handle their medical expenses up to the policy limit. However, it will not cover your own injuries.

Factors to Consider When Choosing Coverage

Selecting the right amount of coverage involves assessing your risk factors and financial situation. Ask yourself the following:

1. How often do you drive? Frequent drivers may face higher risks of accidents.

2. What’s your health insurance coverage like? If you have a robust health plan, you might require less MedPay.

3. Do you drive with passengers regularly? MedPay can protect friends and family in your vehicle.

Additionally, state regulations play a role in determining mandatory coverage. Some states may require MedPay, while others treat it as optional.

Why MedPay Might Be Worth It

Even if you have health insurance, MedPay can be a valuable addition to your auto policy. Health insurance often excludes certain expenses related to accidents, such as chiropractic care or long-term rehabilitation. MedPay ensures these gaps are covered, giving you peace of mind.

For example, if you’re involved in an accident requiring extensive physical therapy, MedPay can help alleviate the financial burden. Similarly, it can cover ambulance fees, which are often excluded from standard health insurance policies.

Balancing Costs and Benefits

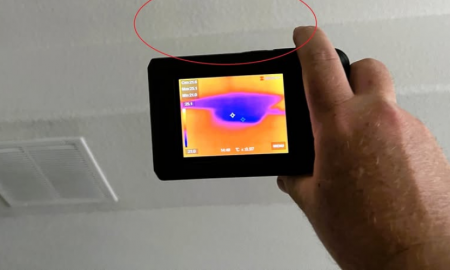

freepik | pressfoto | Medical payments coverage protects you from unexpected medical expenses.

It’s important to evaluate the costs associated with adding MedPay to your policy. While premiums will increase, the financial protection it offers can outweigh the added expense. Consult with your insurance agent to determine an appropriate coverage limit based on your needs. Typical limits range from $1,000 to $10,000, but higher limits may be available depending on your insurer.

Making the Most of Your Insurance Policy

Auto insurance is about more than just compliance—it’s about protecting yourself and others on the road. To maximize your policy:

- Review your coverage annually to ensure it aligns with your current needs.

- Understand the specifics of your policy, including deductibles and coverage limits.

- Ask questions to clarify any uncertainties about how your policy handles medical expenses.

Car accidents can bring both physical and financial stress. Preparing for the unexpected with appropriate coverage can make recovery smoother and less overwhelming. Medical payments coverage offers an extra layer of security, ensuring you’re not left struggling with unforeseen medical expenses. By understanding the differences between MedPay, bodily injury liability, and other coverages, you can make informed decisions that suit your lifestyle and financial needs.

Stay proactive about your insurance policy—your peace of mind and financial stability may depend on it.

More inCar Insurance

-

`

Expert Tips for Protecting Your Home From Natural Disasters

Preparing for natural disasters rarely tops anyone’s weekend to-do list. Yet, with unpredictable weather becoming more common, protecting a home against...

October 17, 2025 -

`

How the New EBT Auto Insurance Discount Guide Helps Low-Income Drivers Save Money

With grocery prices, gas, and utility bills climbing, many families are struggling to make their paychecks last. For those already watching...

October 9, 2025 -

`

Why Truck Manufacturers Are Shifting from Diesel to Hydrogen

Hydrogen is emerging as a promising alternative for trucks, offering both high energy efficiency and longer driving ranges. Ashok Leyland, for...

October 2, 2025 -

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025

You must be logged in to post a comment Login