Tesla Robotaxi Service to Launch Soon – How Will It Affect Tesla Stock?

Tesla’s stock continues to go up as the business gets ready to launch its long-awaited robotaxi service. Scheduled for June in Austin, Texas, this move comes at a pivotal time, especially as investors digest a series of recent developments, including earnings, tariff speculation, and leadership rumors.

Although markets stayed volatile, Tesla shares rose 2.4% last Friday, closing at $287.21. It was the second consecutive week of growth. In comparison, the S&P 500 gained 1.5% while the Dow Jones climbed 1.4%, showing Tesla’s performance stands out.

Robotaxi Rollout Just Weeks Away

Tesla’s long-awaited robotaxi launch is finally near. The company aims to launch the service in June, and sticking to this date plays a key role in the recent stock rise. Since April 22, the day Tesla released its first-quarter earnings, shares have jumped 18%. Investors are watching closely, especially since CEO Elon Musk has repeatedly claimed for nearly a decade that self-driving cars were just a year away.

This time, however, the schedule seems real. Tesla appears committed, and the autonomous driving market is heating up rapidly. Naturally, competition looms. Yet Tesla’s strategy leans heavily on artificial intelligence and real-world driving data—two areas where it maintains a strong lead.

Tesla’s AI-Driven Strategy

Instagram | @product.notion | Tesla’s robotaxi launch in June is a key factor in its stock’s upward trend.

Elon Musk has always believed that advanced cameras and AI can power self-driving vehicles, without relying on high-cost sensors. Although many experts questioned this approach, recent shifts in the industry suggest it may hold more merit than critics once thought.

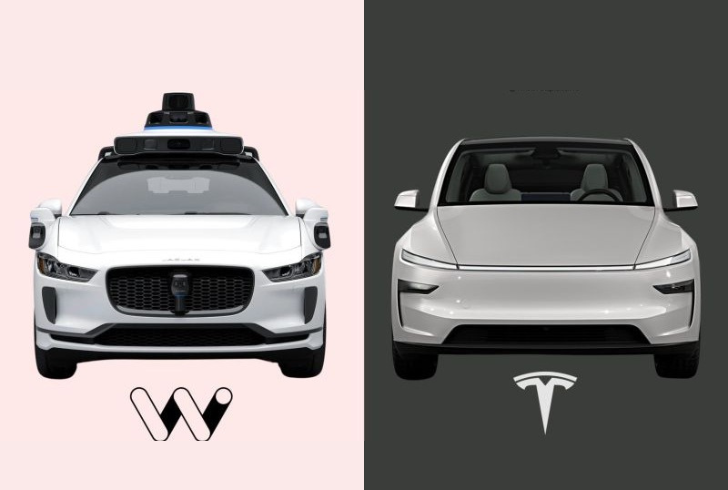

Waymo, Tesla’s top rival in the robotaxi space, completes over 250,000 driverless rides weekly. Their system uses additional sensors, but like Tesla, their core tech relies on artificial intelligence.

Just last week, Waymo announced a major partnership with Toyota. The collaboration focuses on developing self-driving features for personal and commercial vehicles. This alliance underscores a key trend—real-world driving data has become critical for training autonomous vehicle models.

The Power of Real-World Data

Industry analysts now recognize that training AI for autonomy requires immense volumes of real-life data. Tesla benefits from its massive fleet. With roughly 6 million vehicles on the road, most equipped with data-collecting capabilities, Tesla has built a massive training base for its AI models.

Top Morgan Stanley analyst Adam Jonas referred to the Waymo-Toyota partnership as a “major milestone” and said it was “legitimate competition” for Tesla. Even so, he noted that Tesla’s data advantage still stands. Jonas emphasized that both Tesla and Waymo represent the future of autonomous mobility. He also suggested that Tesla may soon explore licensing its self-driving technology to other automakers—a strategy that could significantly boost revenue streams.

Analyst Confidence and Future Projections

Jonas currently rates Tesla stock as a “Buy” and believes its value hinges on its AI capabilities rather than just vehicle sales. His price target? A robust $410 per share. That view aligns with broader market sentiment—53% of analysts covering Tesla maintain a Buy rating. The average analyst price target sits at $304.

Tesla’s rising stock shows how investor confidence builds when technology and delivery align. While the robotaxi rollout hasn’t yet happened, the growing belief that it will arrive on time continues to shape stock momentum.

Other automakers are likely to follow Toyota’s lead, possibly aligning with Tesla to benefit from its deep AI resources. Analysts speculate that Tesla’s self-driving software might eventually power millions of vehicles beyond its own fleet.

What This Means for the Market

Instagram | @global5gevolution | Tesla and Waymo are at the forefront of AI mobility, leveraging their data infrastructure advantage.

Tesla and Waymo now dominate discussions around AI-driven mobility. Their capacity to implement and grow is just as important to their leadership as invention. While traditional automakers work to catch up, these two have already built infrastructure to collect and process the data that fuels autonomous systems.

Real-world performance has replaced theoretical claims. Investors no longer accept vague timelines—they now expect results backed by data. Tesla, after years of bold promises, appears ready to deliver.

A Closing Look Ahead

Tesla’s path forward remains closely tied to its ability to lead in AI, scale data-driven innovations, and meet deadlines. The June robotaxi launch won’t just represent a tech breakthrough—it will likely redefine public and investor confidence in the company’s vision. Given its momentum and timing, Tesla looks poised to reshape not only transportation but also its own financial future.

As deadlines approach and partnerships form across the industry, Tesla’s leadership in AI and autonomy could secure its place at the forefront of the next mobility revolution.

More inAuto News

-

`

Ohio Driver’s License Laws Are Changing for Young Adults in 2025

Getting a driver’s license is a milestone, but for young adults in Ohio, the process is about to become more structured....

September 25, 2025 -

`

Why 1 in 4 Americans Trust RFK Jr. for Medical Advice

A recent poll reveals that a significant portion of Americans remain cautious about trusting Health Secretary Robert F. Kennedy Jr.’s medical...

September 19, 2025 -

`

Why Tariffs Could Make Car Insurance Rates Worse

Car insurance costs in the U.S. are climbing, and new tariffs could make the problem worse. Shoppers are already feeling the...

September 11, 2025 -

`

The Automotive Reckoning Has Arrived – Are Companies Ready?

In early 2022, Stellantis CEO Carlos Tavares stood on stage in Amsterdam with a confident blueprint for the future. Fresh off...

September 5, 2025 -

`

Self-Driving Cars Will “Drastically” Change Automotive Design, GM Says

The automotive industry is entering a new chapter that goes far beyond electrification. While EVs dominate today’s headlines, the rise of...

August 29, 2025 -

`

Child Wearing Swimsuit Outside Sparks CPS Visit — The Full Story!

Children playing outside is a familiar and often joyful sight. Yet, sometimes, an innocent choice—like a child wearing a swimsuit outdoors—can...

August 22, 2025 -

`

Florida Auto Insurance Rates Finally Drop. But for How Long?

After years of rising premiums, Florida drivers are finally seeing lower auto insurance rates on the horizon. For 2025, the state’s...

August 15, 2025 -

`

U.S. Reduces Tariffs on Japanese Cars to 15% Under Trump’s Deal

In a move reshaping U.S.-Japan trade relations, former President Donald Trump confirmed a new agreement that slashes tariffs on Japanese car...

August 9, 2025 -

`

Adults in Ohio Face Stricter Rules to Obtain Driver’s License

Ohio has passed a new law that will change the way adults under 21 get their driver’s licenses. Signed into law...

July 31, 2025

You must be logged in to post a comment Login