5 Strategies to Save on Car Insurance as Tariffs Drive Prices Up

Ford Extends Employee Pricing to All Shoppers Amid Tariff Concerns

Latvia, Austria, and Greece Lead the EU in Dangerous Driving Habits

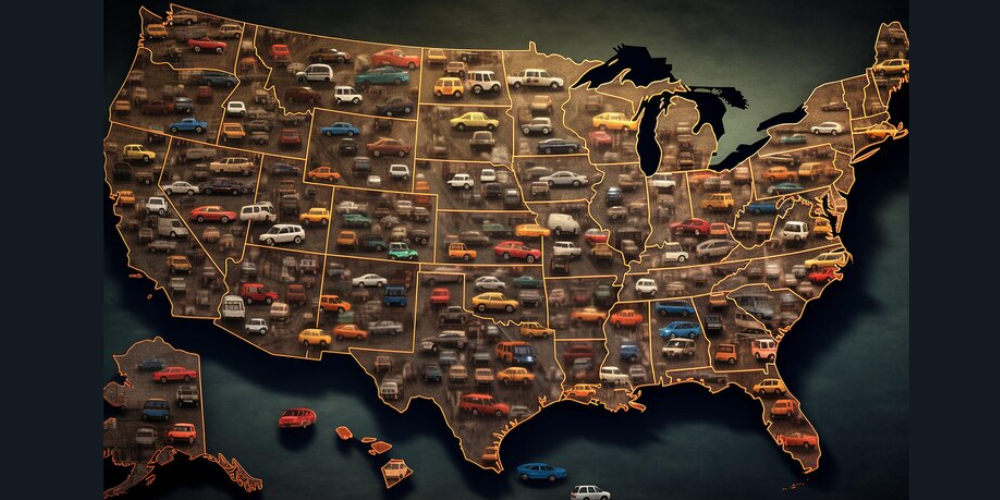

Trump’s Tariffs Are Increasing Car Part Prices – Is Auto Insurance Next...

A Mom’s Unexpected Life Lesson from Her 3-Year-Old’s Slide Moment

-

A Mom’s Unexpected Life Lesson from Her 3-Year-Old’s Slide Moment

Children often surprise adults with their wisdom. A 3-year-old recently proved this when he shared a simple yet profound message before...

AdviceHelen HaywardApril 5, 2025 -

Upcoming Car Tax Changes in April You Should Be Aware Of

Drivers across the UK will soon face higher vehicle tax costs as new regulations take effect in April. These changes will...

DrivingHelen HaywardMarch 30, 2025 -

The Most Frustrating Car Insurance Stories You Won’t Believe

Car insurance is supposed to be a safety net, but for many, it turns into a nightmare. Drivers across the country...

Car InsuranceHelen HaywardMarch 30, 2025 -

Joan Collins’ Two Key Tips Sharon Stone Follows After 40

Sharon Stone continues to embrace aging with confidence, refusing to let societal expectations define her. As she approaches her 67th birthday,...

AdviceHelen HaywardMarch 22, 2025 -

Ford and GM Stocks Drop – Is the Auto Rally Losing Strength?

The U.S. auto industry faces increased uncertainty as stock prices for major car manufacturers, including Ford and General Motors, continue declining....

Auto NewsHelen HaywardMarch 22, 2025 -

Trump’s Tariffs Could Cause a Spike in Car Insurance Prices in 2025

Car insurance premiums have already been rising, and 2025 may bring even higher costs for drivers. President Donald Trump’s proposed import...

Car InsuranceHelen HaywardMarch 15, 2025 -

Tesla Files for Ride-Hailing Service in California, Featuring Human Drivers

Tesla has taken a new step in the ride-hailing industry by applying for a permit to operate a human-driven service in...

DrivingHelen HaywardMarch 15, 2025 -

Mercedes-Benz Cuts Costs, Prioritizes Combustion Engines for Profit Boost

The automotive landscape is shifting, and one major player is recalibrating its strategy to navigate the evolving market. In a bid...

Auto NewsHelen HaywardMarch 8, 2025 -

The Hidden Downsides of Delaying Social Security Until 70

Many people are told to hold off on claiming Social Security until they reach 70 to receive the highest possible monthly...

AdviceHelen HaywardMarch 8, 2025 -

Will Louisiana’s Car Insurance Crisis Get Worse Due to Tariffs?

Tariffs often impact industries in unexpected ways, and Louisiana’s car insurance market might face new challenges because of them. Although most...

Car InsuranceHelen HaywardMarch 2, 2025